What I have experienced in the last few weeks has really soured me on the role of banks in our economy.

I have been trying to get a bank to loan me money to purchase a property in Southern California. I have failed to find a bank that will do it.

Yet, the property’s sale price is equal to its value. Yet, the purchaser – me! – has a good credit score, and has more than enough assets to pledge against the loan if need be. In addition, the purchaser has relationships with several banks, one of which has spanned some 40 years.

None of this seems to matter one bit.

And yet, and yet…the banks will not do a simple loan on the property. Some of them say that if they could do the loan, its terms would be upwards of 50% down, and the remainder to be paid off in 15 years at 10.75% interest. Holy cow!!

Not only that, they say that if they could do it, they would need to take up to 60 days to process the application. 60 days!!

What could be going on, I ask myself.

- Could it be that all banks are unbelievably conservative institutions, led by people who are accountants and auditors at heart.

- Could it be that the recent failure of three “regional” banks has scared the other banking institutions such that they are immobilized and traumatized.

- Could it be that banks are institutions that serve no real purpose and have outlived their usefulness. Could it be that they are fossils?

- Could it be that banks can’t get out of the way of their own policies and procedures.

I say this having worked in a bank for two summers when I was much younger. As a result I have a soft spot in my heart for banks because of that experience.

Although I was only in my late teens a to remain nameless bank took a chance on me and offered me opportunities to grow and develop. I will never forget it.

For example, the first summer they asked me to be one of the two men that opened the bank in the morning. I had to be there at 8am to accompany one of the bank’s vice presidents to unlock the doors, open the safe, turn the lights on, and get the bank ready for its employees and then later its customers. I had to do this Monday through Friday every week in the summer.

This may not sound like much but I took it as a real compliment that they would entrust someone my age to be the second person in a situation where security was at stake.

What you will not believe is what it took for me to be there at 8am every morning. I lived at the time some 11+ miles away from the bank. However, my trip to the bank each day was not a straight shot – get in your car, turn the motor on, check the gas gauge, put it in first gear, drive 40 minutes to the bank. No.

What made my trip to the bank challenging was that I lived on an island, which required a ferry ride to the mainland in order to make the last 9 miles of the trip. You can probably guess what the problem was by now. My island ferry did not start running until 8am. Yet I was supposed to be some 11+ miles away in a different town by 8am to open the bank’s doors.

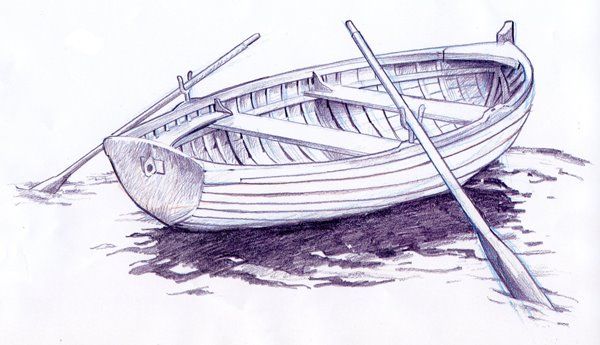

What to do? So, what I did was drive one of my parents’ cars to the ferry landing on the island at 6:30 am every weekday morning. I got out of the car and found the little rowboat that I had tied to a bush along the beach near the ferry landing. I got the oars out of my car and placed them in the rowboat. I untied the line to the bush and began to push the rowboat into the water. But wait, I forgot to mention one thing.

Even though this was a summer job and in a summer/vacation-like location, I had to wear a business suit to work. I was working in a bank, not an ice cream parlor. So, each morning I was dressed in a dark suit, white shirt, tie, dark socks and black shoes. But, to make the water crossing in my rowboat I would have to get wet pushing the rowboat in the water, no question about it. at this point I untie my shoes and take off my socks. Then I roll up my pants to my knees. I need to do this to be able to get the rowboat off the sand and into the water. Once the rowboat is in the water I then step into the water and into the boat holding my shoes and socks in the air so that they don’t get wet. Once in the rowboat, I begin to paddle the 527 feet distance needed to cross the channel that the ferry normally traverses. I do so in my suit and tie with my shoes and socks on the seat next to me. I row and row across the channel which can have a decent current depending upon the tide schedule. This takes approximately 20 minutes.

Once I reach the mainland I tie the rowboat up to the pier, climb out and proceed to put my socks and shoes back on. Then I find another of my parents’ cars which I left on the mainland. I unlock it, open the door, put the key in the ignition, and proceed to travel the remaining 9 miles to get to the bank by 8am to open the doors.

I did this every weekday for two summers.

I was rewarded by the bank for my work in the second summer when they promoted me to teller. This was something really special back then. A teller back in the 60’s played a really important role in a bank. A teller was the face of the bank. A teller had relationships with the bank’s customers, both individuals and businesses. A teller cashed checks, made deposits, and made loans! Yes, indeed. Now, of course, the loans had to be approved by one of the bank’s vice presidents, but the loan was initiated and handled by the teller. On top of all that, each day the teller had to “check out” – reconcile their ending cash with their beginning cash, the day’s deposits and disbursements. Everything had to balance at the end of every day. This was done under the watchful eye of a vice president and had to be done before you could go home.

One of the challenges that I loved at the time was seeing who could “check out” in the shortest period of time each day. Who was the fastest at reconciling.

Once reconciled, once ‘checked out”, I could head for home. i got in my car and retraced my route, driving 9 miles to the ferry landing. Even though the ferry was running at this time of day, I had to take off my shoes and socks and roll up my pants again so that I could get into my rowboat to row across the channel so that I could be sure the rowboat was ready for my trip the next morning.

Just another day at work!!

My point in telling this story is that there was a time when a bank was a caring institution. One that was an integral part of the community. One that had real people working for it. One where relationships with its customers were so genuine and meaningful.

Oh, how I miss those days!

I can’t believe this is the first time I have heard this story! Wow, serious dedication!

I spent 43 years in the banking industry working for one of the Big 5 in Canada, then a Regional, followed by the world’s then 4th largest International Bank. Canadian Banks have been the envy of the industry worldwide, due to their stability and strength. In fact in the past 20 years they’ve been gobbling up US Banks at breakneck speed (TD, RBC, BMO, Scotia and CIBC are short forms for their Canadian roots Toronto Dominion, Royal Bank of Canada, Bank of Nova Scotia and Canadian Imperial Bank of Commerce.

Recently a friend tells me he too found negotiating a personal loan was way too frustrating compared to years ago, but it did not sound as convoluted as the mortgage situation you describe.

Neil, the reason there were 2 Officers needed to open the vault etc in the morning was for joint custody (each keeps the other honest in their duty). The reason Junior’s were used was for cannon fodder. Most armed assaults occurred at opening time where hostages are taken and the vault combinations demanded to be spun! I too did this duty for several months and it was not an honor, it was a reality that I was the one to be sacrificed should anything go awry!

If you think borrowing is getting wingy down there, fasten yer seatbelt! Biden is auguring to force banks to lend to deadbeats at the expense of those with great credit ratings. This will not end well, just like Clinton’s scheme to have banks lend to marginalized people in proportion to their representation in the local population which was the initial genesis of the last Mortgage Bubble bust around 2008..

Does your broker have any advice?

Could be you should just stay where you are…..

👍🏻

May be it’s a message that you need to stay where you are!😆 Neal, we don’t want to see you leave. You have too many friends here!!!