Every child born in America today enters the world with a share of the national debt exceeding $100,000.

That figure comes from simply dividing the $36.22 trillion national debt by the U.S. population of about 335 million—roughly $108,000 per person. It’s not a bill being sent to a newborn, of course—but it is a powerful way to understand the scale of what we’re passing along.

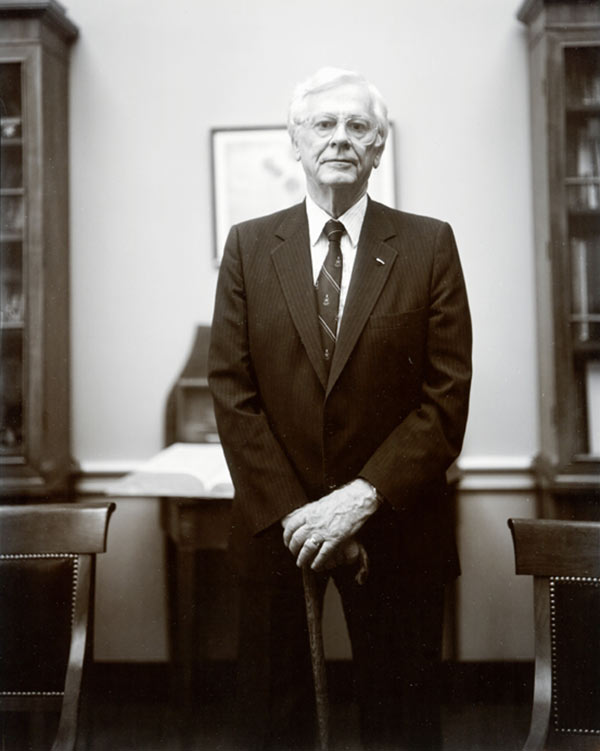

When I worked on Capitol Hill in the 1960s, I had the honor of interning for Congressman Charles E. Bennett of Jacksonville, Florida. Charlie, as I called him, was a Democrat, a World War II veteran, and a man who had overcome polio to serve his country—first in uniform, then in Congress. He walked with a pronounced limp, wore a metal leg brace, and relied on a cane for support. But he never wavered.

At the time, he held the longest unbroken voting record in Congress. He never missed a vote. He dictated every response to his constituents himself, long before email and automation. But the thing that still moves me most? Every month, Charlie donated his entire veterans and disability checks to the U.S. Treasury—to help reduce the national debt.

He didn’t do it for headlines. He did it because he believed in personal responsibility and in leaving this country better than he found it.

That memory—of Charlie’s quiet, unwavering integrity—has stayed with me for over 60 years. And it’s part of what’s motivating me now to speak up again.

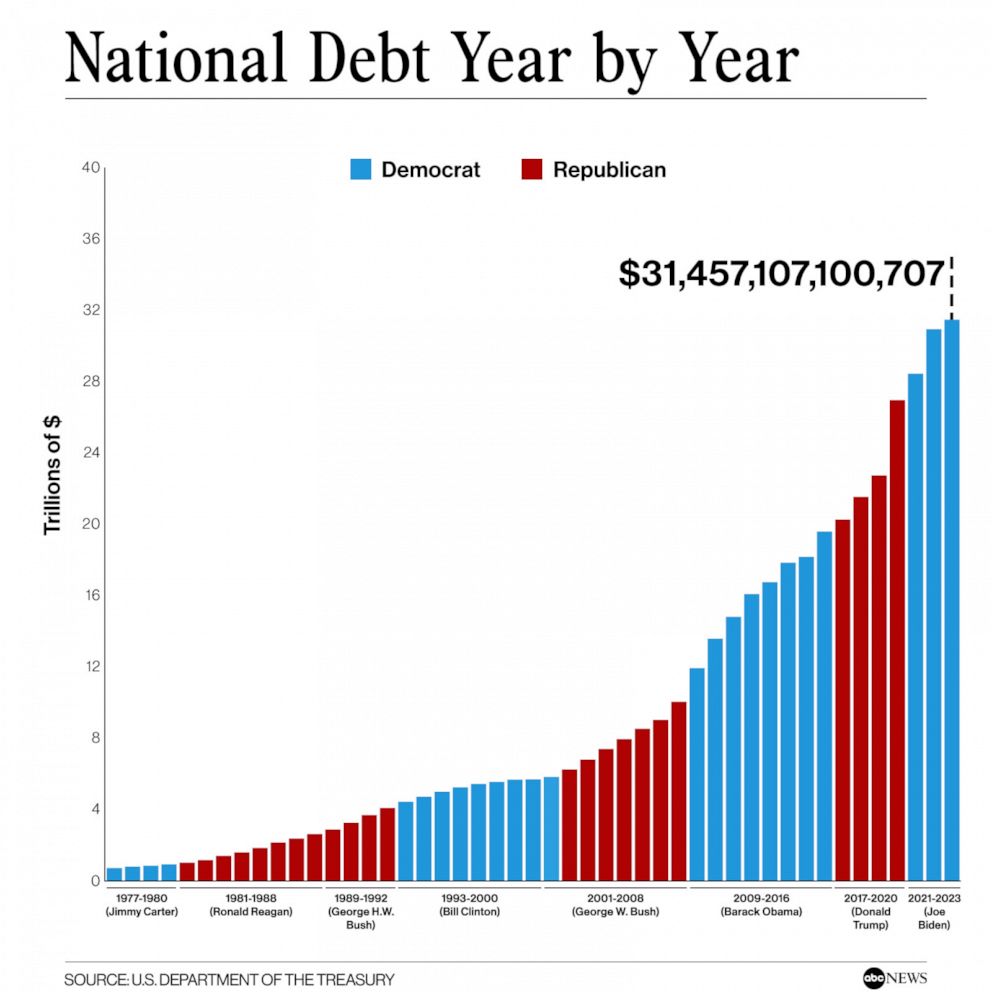

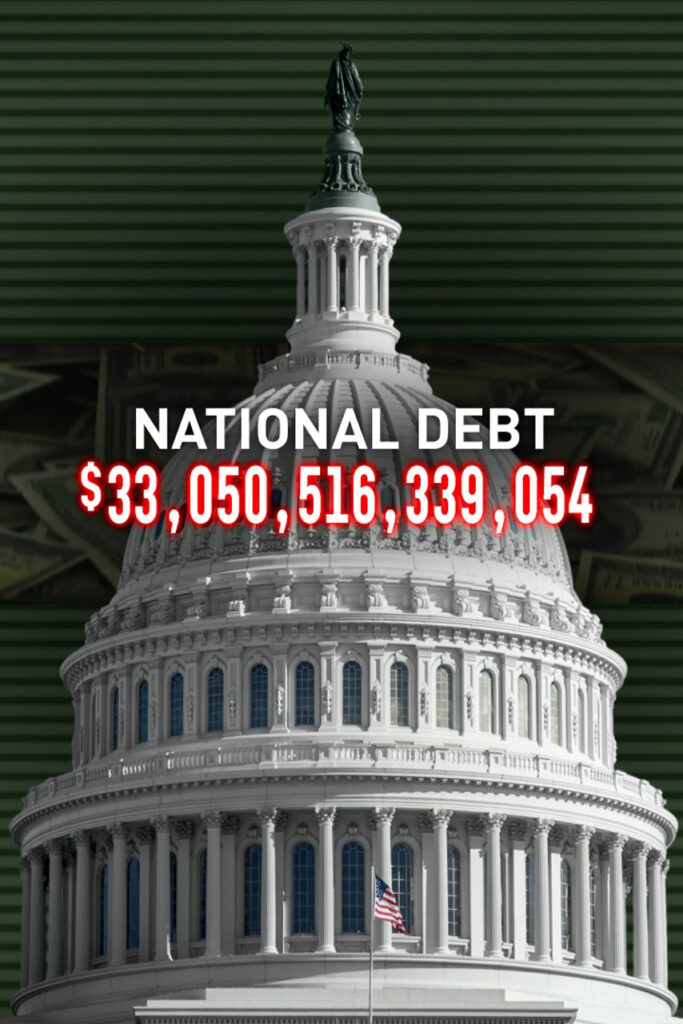

The Debt Is Real—and It’s Growing

Today, America owes $36.22 trillion, or about 123% of our GDP. Interest alone now costs us more than $1 trillion every year—money we’re not investing in our children, our communities, or our future.

This is more than a fiscal issue. It’s a moral one.

To make it personal and relatable:

- The national debt equals about $341,700 for every federal income taxpayer

- Or about $369,600 for every household above the poverty line

If we wanted to eliminate the entire debt in one generation—say, over 20 years—each taxpayer would need to contribute about $17,085 per year, and each household above the poverty line about $18,480 per year.

But that’s not our goal.

The Goal: Sustainability, Not Perfection

We don’t need to eliminate the debt entirely. But we do need to bring it back to a sustainable level—75% of GDP—within the next two decades.

To do that, we’d need to reduce the debt by about $13 trillion. That’s still a heavy lift, but it’s far more achievable.

Spread over 20 years, that means:

- $6,667 per year per federal income taxpayer, or

- $7,212 per year per household above the poverty line

This is a challenge. But it’s one we can meet—if we share the load.

Five Pillars of a National Debt Reduction Plan

Here’s how we do it—together:

- Waste, Fraud, and Abuse

Crack down on waste, fraud, and abuse in federal programs through tighter enforcement and oversight. Modernize outdated IT systems and streamline administrative operations to improve efficiency and reduce duplication.

Estimated impact: $1.4 trillion over 20 years

- Corporate Taxes and Contributions

Raise the corporate tax rate modestly—from 21% to 28%, a level closer to historical norms. Close major loopholes that allow corporations to avoid taxes through tactics like offshoring profits, accelerated depreciation, and excessive deductions. Apply a 15% minimum tax on reported book income to ensure profitable companies contribute fairly. Also increase the tax on stock buybacks from 1% to 4%, and implement a carbon tax to hold major corporate polluters financially accountable.

Estimated impact: $11.29 trillion

- Entitlement Reform

Gradually raise the retirement age—from 67 to 69 over time—to reflect increased life expectancy. Apply means-testing so that higher-income retirees receive reduced benefits. And eliminate the Social Security payroll tax cap, which currently exempts wages above $168,600 from further contributions.

Estimated impact: $4 trillion

- Economic Growth

Sustain 2.5% annual GDP growth through smart policy, innovation, and productivity gains. Invest in infrastructure—roads, bridges, broadband—and other public-private partnerships that create jobs and long-term economic value.

Estimated impact: $4.5 trillion

- Family and Personal Commitment

A modest national sales tax—say, just 0.1% (one-tenth of one percent)—and voluntary contributions to a Debt Reduction Trust. Even at that low rate, a national sales tax could generate significant long-term revenue when applied broadly and fairly.

Estimated impact: $1–2 trillion

Together, these steps can eliminate the $6,667 to $7,212 annual burden per household or taxpayer—and restore fiscal health for future generations.

Let’s Start a Movement

We don’t have to wait for Washington to fix this. What if we, as parents and grandparents, neighbors and citizens, decided to lead the way? What if we created a grassroots movement—one rooted in responsibility, not politics—to take this issue seriously and push for action? Let’s come together, across parties and generations, and make reducing the national debt a legacy we can be proud of.

Let’s Do This—for Our Kids

This isn’t about political ideology. It’s about the kind of country we leave behind.

Charlie Bennett didn’t wait for someone else to fix things. He stepped up. Quietly. Consistently. Faithfully. He taught me that citizenship isn’t a spectator sport.

So I ask you:

What legacy will we leave?

“We saw the problem. We took responsibility. We didn’t leave the bill for our children.”

Let that be the story we write—together.

BRAVO!

—Baze

I’m in!

Well stated. The threat to our nation from mounting debt is real. It is also the time to tackle it.